Consumers

1) What if I have a dispute with my insurer?

If you feel you have been treated unfairly by your insurer, you should lodge a complaint directly with the insurer, and provide the insurer with your details (name, contact numbers, etc.), the specific nature of your complaint and supporting documents.

The insurer should acknowledge your complaint within 7 business days, and if necessary, request additional information from you within 7 business days of the date of your complaint.

Depending on the nature of your complaint, the insurer may need more time to attend to it. If so, the insurer should contact you and update you on the progress within 15 business days of your last communication, before proceeding to resolve the problem.

If you have taken these steps and still feel the response is not satisfactory, or if there is no response within the timeframes stated above, you should then appeal to the Chief Executive of the insurer in writing. You can expect a response to this within 15 business days.

Finally, if you are still unsatisfied after going through these channels, you can contact the Financial Industry Disputes Resolution Centre Ltd (FIDReC). FIDReC is an independent institution which aims to provide consumers with a one-stop avenue for resolving disputes in the banking, insurance and capital market sectors.

Filing a complaint is simple and free of charge. You may lodge your complaint online at www.fidrec.com.sg. If you have any queries or difficulties in lodging the complaint, you may submit an enquiry at www.fidrec.com.sg or contact FIDReC at 6327 8878.

For more information, please visit www.fidrec.com.sg.

2) If I have a dispute with the third party insurer on the question of liability and quantum of settlement amount, who can help me to resolve the dispute?

You can approach FIDReC. In addition to handling insurance disputes involving claims between insureds and their insurers, FIDReC also handles motor third-party property damage claims of up to S$100,000 (for claims filed before 1 July 2024) or S$150,000 (for claims filed on or after 1 July 2024).

For more information, visit FIDReC’s website at www.fidrec.com.sg.

Travel Insurance

Travel insurance has become essential to safeguard one against unforeseen circumstances. It provides you with peace of mind in the event of unforeseen circumstances which result in any possible losses before, during and even after a vacation or overseas trip. Unforeseen circumstances include cancellation of trip due to serious illness, accidental injury, high medical bills, travel disruption, loss of personal belongings and personal liability.

Types of Travel Insurance

Single Trip: A short term policy covering a specific trip, usually commencing from and returning to Singapore.

Annual Cover: A policy issued for a one-year period covering trips commencing from and returning to Singapore, undertaken by the insured person(s) during the policy year, subject to its terms and conditions.

Individual Plan: A policy covering the policyholder or any other individual person.

Family Plan: A policy covering the policyholder and his immediate family. A cap may be imposed on the number of insured persons under a Family Plan policy

What Should You Consider before Buying Travel Insurance?

Everyone’s needs and expectations differ but some useful factors to consider include:

How frequently do you travel?

Frequent travellers may want to consider purchasing an Annual Cover instead of Single Trip policies for each trip.

Where are you travelling to?

The cost of travel insurance will differ depending on the location of your destination. Most travel insurance have territorial limits. insurers usually divide the world map into different geographical regions / zones. A common classification will be ASEAN / Asia / Worldwide.

Where are you travelling to? Is there convenient access to medical facilities and is the destination prone to natural disasters or inclement weather?

If you are travelling to a destination with inadequate medical facilities, comprehensive medical coverage that covers you for medical treatment costs and emergency medical evacuation may be required.

Becoming an Agent

The Insurance Act regulates the distribution of insurance. Section 1A of the Act sets out the interpretation of insurance agent.

If you perform any of these activities, you are likely to be considered to be acting as an insurance agent:

i. receiving proposals for, or issuing, policies in Singapore;

ii. collecting or receiving premiums on policies in Singapore; or

iii. arranging contracts of insurance in Singapore; or

iv. earning a commission or fee that is tied to the value of the premium transacted; or

v. providing insurance sales or product advice.

Before acting as an insurance agent for distributing general insurance products, the person or company must register with the Agents' Registration Board (ARB) through the principal insurers that they wish to represent.

Prospective applicants should discuss your business plans with the insurers that you wish to work with and form your opinion on whether you are likely to be acting as an insurance agent. You should seek your own legal advice if you are not clear.

Persons who act as unregistered insurance agents will be referred to the Monetary Authority of Singapore for action under the Insurance Act.

Types of Agents

- Individual Agent – a person

- Corporate Agent – a business entity i.e. sole proprietorship, partnership or company registered with ACRA, society/cooperative society registered with Registrar of Societies.

- Trade Specific Agent (TSA) – a business entity that is engaged in a business where insurance is not its core business. It can act for its principal insurers to sell specific insurance products relating to its core business only.

- Nominee Agents – a person who acts for the above types of agents. Corporate agents and TSAs must have at least 1 nominee agent at all times.

Applicants are advised to read and understand the rules and regulations before registration. Registered agents will have to abide by the rules at all times. Please refer to the relevant information as follows (click on the link):

Applicants or agents who have any questions on the requirements or regulations for agents may discuss with their principal insurers.

Registration Fees

License of the registered agents are valid for the calendar year. All registered agents (except for Trade Specific Agents other than Motor Trades) are to fulfil their Continuing Professional Development (CPD) requirements to be qualified for renewal of their license. Agents may refer to this link on CPD requirements.

Applicants applying to be an agent are subjected to a registration fee per Principal representation. The fee shall be paid to the Principal directly. This will also apply to all additional nominees.

Renewal fee per Principal representation will be imposed on all agents (including nominee agents) who have met the requirements upon renewal of license at the end of the year. You may refer to the fees table at this link:

Agents Search

The public can check if a general insurance agent is registered with ARB, and the insurers that the agent is authorized to represent, by using the agent search module at this link.

When performing a search for an individual agent or a nominee agent, you must have the NRIC/FIN/Passport number or the GIA nominee number.

When performing a search for a corporate agent or trade specific agent, you must have the GIA number, company name or the business registration number.

Registered agents may also use the above link to display their registration status to customers with their mobile devices.

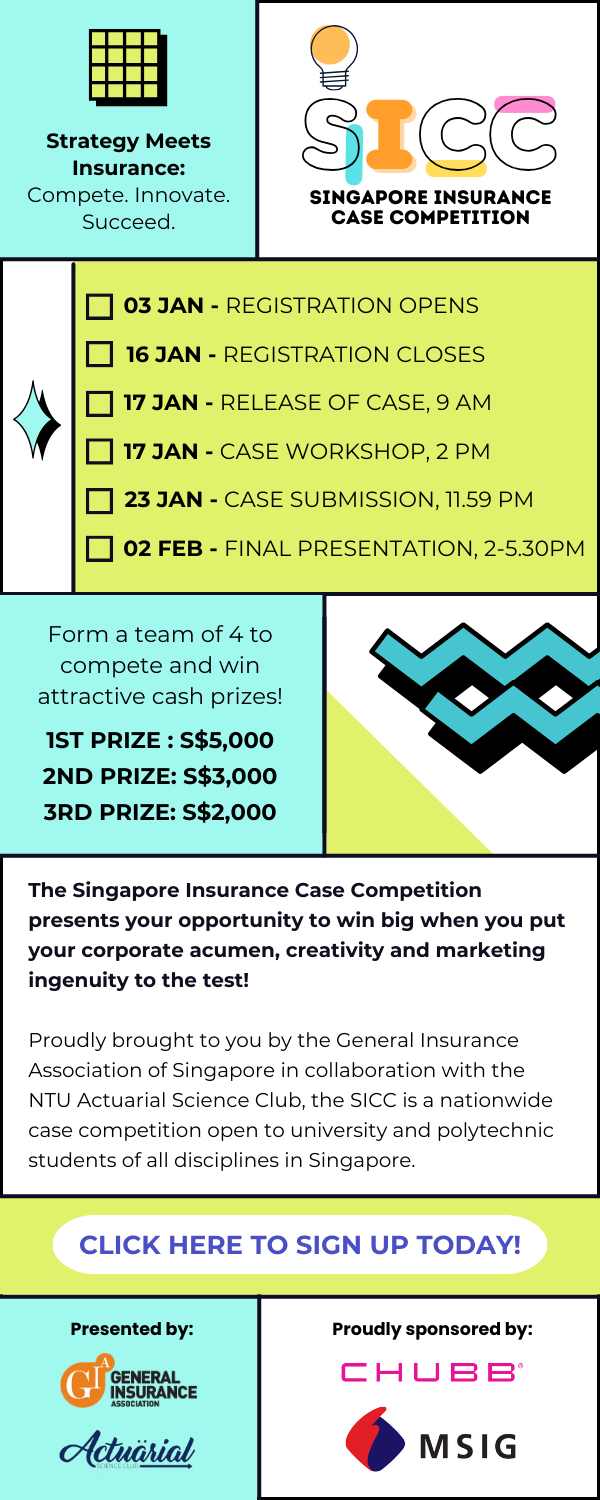

Win up to S$5,000 in cash prizes!

The Singapore Insurance Case Competition (SICC) presents your opportunity to win big when you put your corporate acumen, creativity, and marketing ingenuity to the test!

Gather a multi-talented team of 4 to brainstorm and pitch THE proposal to compete for exciting cash prizes.

Proudly brought to you by the General Insurance Association of Singapore in collaboration with the NTU Actuarial Science Club, the SICC is a nationwide case competition open to university and polytechnic students of all disciplines in Singapore. This year, SICC is proudly sponsored by Chubb Insurance Singapore Limited and MSIG Insurance Singapore, two industry-leading general insurance companies.

Important Dates & Times:

Case Release – 17 Jan 2024, 9 am

Case Workshop – 17 Jan 2024, 2 pm

Case Submission – 23 Jan 2024, 11.59 pm

Final Presentation – 2 Feb 2024, 2 pm to 5.30 pm

Follow SICC on Instagram for more updates here!

5. About

Established in 1966, the General Insurance Association of Singapore (GIA) constantly works to make all aspects of general insurance easier and more effective for consumers, agents and insurers based in Singapore.

As a Trade Association, we are actively involved in the business community representing the interests of our member companies. We assist in identifying emerging trends and responds to issues affecting the General Insurance industry. We seek to promote the overall growth and development of the Singapore General Insurance sector.

We are constantly improving our processes to adapt in the ever-changing business landscape, to ensure that our mission and structure continue to meet the business needs of our member companies.

Mission & Vision

The GIA Constitution empowers the Management Committee to embark on activities that promote and advance the common interests of members and the general insurance industry through:

- Fostering public confidence in, and respect for, the insurance industry

- Representing members' interests to Government, trade organisations, similar associations and bodies in other industries

- Establishing a sound insurance structure and promotion of greater efficiency within the industry

- Promoting education and training in all aspects of insurance

- Being a good corporate citizen

Management Committee

GIA's Management Committee is responsible for charting the way forward for the association.

The Committee determines the policies, initiatives and activities to adopt, in the interest of consumers and GIA members.

The Management Committee gives the GIA the direction it needs to develop the Singapore insurance industry.

Members of the Management Committee (2024-2026)

|

|

|

President |

Ronak Shah (QBE Insurance (Singapore) Pte Ltd) |

|

Vice-President |

Andrew Yeo (Income Insurance Limited) |

|

Honorary Secretary |

Jimmy Tong (Great Eastern General Insurance Limited) |

|

Honorary Treasurer |

Scott Spaven (AIG Asia Pacific Insurance Pte Ltd) |

|

Members |

Hicham Raissi (Allianz Insurance Singapore Pte Ltd) |

|

Hng Keng Yoong (Chubb Insurance Singapore Limited) |

|

|

Adrian Vincent (FWD Singapore Pte. Ltd.) |

|

|

Yasar Fistikci (Liberty Insurance Pte Ltd) |

|

|

Mack Eng (MSIG Insurance (Singapore) Pte. Ltd.) |

|

|

|

|

|

Agents' Registration Board |

|

|

Chairman |

Jimmy Tong (Great Eastern General Insurance Limited) |

|

Members |

Pamela Yeo (AIG Asia Pacific Insurance Pte. Ltd) |

|

Andrew Lee (China Taiping Insurance (Singapore) Pte. Ltd) |

|

|

Jean Ong (Chubb Insurance Singapore Limited) |

|

|

Kevin Xiong (Direct Asia Insurance (Singapore) Pte Ltd) |

|

|

Adam Tang (EQ Insurance Company Limited) |

|

|

Cecilia Siah (Income Insurance Limited) |

|

|

Sheena Tan (Liberty Insurance Pte Ltd) |

|

|

Edna Ngo (Sompo Insurance Singapore Pte. Ltd) |

|

|

Joanne Huang (Tokio Marine Insurance Singapore Ltd) |

|

Standing Committees

|

|

|

Insurance Fraud Committee |

|

|

Convenor |

Andrew Yeo (Income Insurance Limited) |

|

Members |

Mohamad Nazri Ahmad (AIG Asia Pacific Insurance Pte Ltd) |

|

Sam Callaghan (Direct Asia Insurance (Singapore) Pte Ltd) |

|

|

Norman Bay (Income Insurance Limited) |

|

|

Gabriel Wee (India International Insurance Pte Ltd) |

|

|

Andy Foo (Liberty Insurance Pte Ltd) |

|

|

Ivan Ho (MSIG Insurance (Singapore) Pte. Ltd.) |

|

|

Srajudeen S/O Syed Sulaiman (Sompo Insurance Singapore Pte Ltd) |

|

|

Choo Kwang Meng (Commercial Affairs Department) |

|

|

Alan Kit (Commercial Affairs Department) |

|

|

IUMI 2025 Organising Committee |

|

|

Convenor |

Mack Eng (MSIG Insurance (Singapore) Pte. Ltd.) |

|

Members |

Elaine Wong (Allied World Assurance Company, Ltd) |

|

Chong Ai Mei (Great American Insurance Company) |

|

|

Shailja Bhatara (India International Insurance Pte Ltd) |

|

|

Justin Xu (Münchener Rückversicherungs-Gesellschaft, Singapore Branch) |

|

|

Alex Lim (QBE Insurance (Singapore) Pte Ltd) |

|

|

Tan Beng Tee (Singapore Maritime Foundation) |

|

|

Priscilla Foo(Swiss Re Asia Pte Ltd ) |

|

|

|

|

|

Marine Committee |

|

|

Convenor |

Yasar Fistikci (Liberty Insurance Pte Ltd) |

|

Members |

Mark Watts (Allied World Assurance Company, Ltd) |

|

Tan Woei Chi(AXA XL) |

|

|

Paul Hackett (Canopius Asia Pte. Ltd.) |

|

|

Nicholas White (Glaven Marine Pte Ltd) |

|

|

Wang Meixian (Kuok Group Singapore) |

|

|

Yu Bo (Markel International Singapore Pte Ltd) |

|

|

Ramachandran Radakrishnan (QBE Insurance (Singapore) Pte Ltd) |

|

|

Leong Kah Wah (Rajah & Tann Singapore LLP) |

|

|

Tan Beng Tee (Singapore Maritime Foundation) |

|

|

Alexandros Ampatzis (Tokio Marine Kiln) |

|

|

Aaron Wee (W K Webster & Co Ltd) |

|

|

Medical Committee |

|

|

Convenor |

Adrian Vincent (FWD Singapore Pte. Ltd.) |

|

Members |

Yeoh Kai Tze (Cigna Europe Insurance Co S.A. - N.V., Singapore Branch) |

|

Keerti Sethia (HSBC Life (Singapore) Pte. Ltd) |

|

|

Susan Ong (Income Insurance Limited) |

|

|

Esther Lee (Liberty Insurance Pte Ltd) |

|

|

Daren Ng (MSIG Insurance (Singapore) Pte. Ltd.) |

|

|

Iris Chan (Raffles Health Insurance Pte. Ltd.) |

|

|

Allan Han (Tokio Marine Insurance Singapore Ltd) |

|

|

Motor Committee |

|

|

Convenor |

Hicham Raissi (Allianz Insurance Singapore Pte Ltd) |

|

Deputy Convenor |

Mekavathanan Sarangapani (India International Insurance Pte Ltd) |

|

Members |

Joey Cheong (AIG Asia Pacific Insurance Pte. Ltd) |

|

Fang Wenkai (Direct Asia Insurance (Singapore) Pte Ltd) |

|

|

|

Chia Ka Wei (EQ Insurance Company Limited) |

|

Christopher Chionh (HSBC Life (Singapore) Pte. Ltd) |

|

|

Susan Ting (Income Insurance Limited) |

|

|

Roy Wong (Liberty Insurance Pte Ltd) |

|

|

Kamini Kanagalingam (MSIG Insurance (Singapore) Pte. Ltd.) |

|

|

Barry Robinson (QBE Insurance (Singapore) Pte Ltd) |

|

|

Alvino Kor (Singapore Life Ltd) |

|

|

Valencia Lee (Tokio Marine Insurance Singapore Ltd) |

|

|

Talent Committee |

|

|

Convenor |

Hng Keng Yoong (Chubb Insurance Singapore Limited) |

|

Members |

Chervina Cheng (AIG Asia Pacific Insurance Pte Ltd) |

|

Erin Kim (Chubb Insurance Singapore Limited) |

|

|

Deidre Ong (Income Insurance Limited) |

|

|

Celine Rose (Liberty Insurance Pte Ltd) |

|

|

Sharon Teo (MSIG Insurance (Singapore) Pte. Ltd.) |

|

|

Shalini Pavithran (Singapore College of Insurance) |

|

|

Work Injury Compensation Committee |

|

|

Convenor |

Scott Spaven (AIG Asia Pacific Insurance Pte. Ltd.) |

|

Members |

Berlin Lim (AIG Asia Pacific Insurance Pte. Ltd.) |

|

Ng Kok Hee (Allied World Assurance Company, Ltd (Singapore Branch)) |

|

|

Celine Goh (Berkshire Hathaway Specialty Insurance Company) |

|

|

Rico Li (Chubb Insurance Singapore Limited) |

|

|

Vernon Ong (EQ Insurance Company Limited) |

|

|

Tracy Tan (ERGO Insurance Pte. Ltd.) |

|

|

Vikki Tan (Income Insurance Limited) |

|

|

Zuhaidah Bte Samsuri (India International Insurance Pte Ltd) |

|

|

Lim Wan Yen (Liberty Insurance Pte Ltd) |

|

|

Rachel Teo (MSIG Insurance (Singapore) Pte. Ltd.) |

|

|

Rachel Pu (QBE Insurance (Singapore) Pte Ltd) |

|

|

Ng Chee Meng (Singapore Life Ltd) |

|

|

Audrey Lim (Sompo Insurance Singapore Pte. Ltd.) |

|

|

Lee Li Li (Tokio Marine Insurance Singapore Ltd) |

|

Workgroups |

|

|

Finance & Tax Workgroup |

|

|

Chairman |

Adrian Chua (Tokio Marine Insurance Singapore Ltd) |

|

Members |

Howard Goh (AIG Asia Pacific Insurance Pte. Ltd) |

|

Ury Gan (Income Insurance Limited) |

|

|

Chock Ker Ching (MSIG Insurance (Singapore) Pte. Ltd) |

|

|

Sustainable Underwriting Workgroup |

|

|

Chairman |

Rebecca Rowan (Great Eastern General Insurance Limited) |

|

Members |

Yann Marmonier (Canopius Asia Pte. Ltd.) |

|

Lin Dapeng (China Taiping Insurance (Singapore) Pte. Ltd.) |

|

|

Jeremy Lian (MSIG Insurance (Singapore) Pte. Ltd. ) |

|

|

Chia Ko Wen (Singapore Life Ltd) |

|

|

Christy Yeo(Zurich Insurance Company Ltd (Singapore Branch) |

|

|

Edward Rayfield (Zurich Insurance Company Ltd (Singapore Branch) |

|

|

GIA Representatives Sitting On External Committees |

|

|

Motor Insurers' Bureau (MIB) |

|

|

Chairperson |

Mr Mekavathanan Sarangapani (India International Insurance Pte Ltd) |

|

Deputy Chairperson |

Ms Kamini Kanagalingam (MSIG Insurance (Singapore) Pte Ltd) |

|

Councillors |

Mr Jegaprakash Yogarajah (AIG Asia Pacific Insurance Pte. Ltd.) |

|

Mr Vincent Ho (HSBC Life (Singapore) Pte. Ltd.) |

|

|

Mr Eddie Loke (Income Insurance Limited) |

|

|

Alternate Councillors |

Ms Jenny Pe (Income Insurance Limited) |

Member: Mr. Ronak Shah (GIA President)

East Asian Insurance Congress (EAIC)

Executive Board: Mr. Ronak Shah (GIA President)

Institute of Banking and Finance

Member: Mr. Ronak Shah (GIA President)

International Union of Marine Insurance (IUMI)

Representative: Mr. Paul Hackett

Singapore College of Insurance (SCI)

Board of Governors: Mr. Ronak Shah (GIA President) and Mr. Andrew Yeo (GIA Vice-President)

GIA Past Presidents

|

Name |

Year |

|

Tan Hoay Gie |

1966 – 1967 |

|

A.G. Mackenzie |

1968 |

|

A.D. Moodie |

1969 |

|

Maurice C. Lee |

1970 |

|

Tan Hoay Gie |

1971 |

|

A.T. Shimpi |

1972 |

|

Chew Loy Kiat |

1973 – 1975 |

|

A.T. Shimpi |

1976 – 1979 |

|

Tan Hoay Gie |

1978 – 1979 |

|

Hwang Soo Jin |

1980 – 1981 |

|

Koh Bee Chye |

1982 – 1983 |

|

Teo Kwang Whee |

1984 – 1985 |

|

Hwang Soo Jin |

1986 – 1987 |

|

Koh Bee Chye |

1988 – 1989 |

|

Peter Lee Bong Soo |

1990 – 1991 |

|

Peter Yap Kim Kee |

1992 – 1993 |

|

David Chan Mun Wai |

1994 – 1995 |

|

Loo Sun Mun |

1996 – 1997 |

|

Albert Koh |

1998 – 1999 |

|

Seow Nee Chek |

2000 |

|

Law Song Keng |

2001 – 2002 |

|

Terence Tan |

2003 – 2004 |

|

Derek Teo |

2005 – 2013 |

|

A.K. Cher |

2013 – 2018 |

|

Karl Hamann |

2018 – 2019 (Jun) |

|

A K Cher |

2019 (Jun) – 2020 (Mar) |

|

Craig Ellis |

2020 (Mar) - 2022 |

|

Ronak Shah |

2022 - Present |

GIA Secretariat

The GIA Secretariat is charged with all operations at the GIA.

The secretariat supports the Management Committee and the GIA members with the implementation of all GIA activities.

Ho Kai Weng

Chief Executive

Agents' Registration Board

Texas Hong

Director, Insurance & Agents’ Registration Board

Vanessa Lim

Assistant Manager, Agents' Registration Board & Membership

Helen Lum

Administrator, Distribution

Corporate Communications Department

Jessica Li

Senior Manager, Communications and Sustainability

Ashley Kok

Senior Executive, Communications and Marketing

Corporate Services Department

Lee Qing

Manager, Corporate Services

Muhaimin Yusoff

Senior Executive, Events and Corporate Services

Rosalind Cher

Customer Service Officer

Insurance Department

Texas Hong

Director, Insurance & Agents’ Registration Board

Sharon Chen

Assistant Manager, Insurance

Cynthia Chan

Senior Executive, Insurance

Iris Ng

Administrator, Insurance

6. Consumers

7. Careers

Kick-start Your Career in General Insurance

The General Insurance sector in Singapore is a $22.9 billion industry, providing an expansive range of job opportunities. Whether your interest lies in analysing statistical data or developing the next award-winning marketing campaign, there is a suitable job role waiting for you to discover.

Click on the job profiles below to learn more about the diverse job roles in General Insurance.

Common Features & Exclusions

Besides the fact that it is against the law in Singapore to drive a motor vehicle without a valid insurance policy to cover third party bodily injury, motor insurance makes good sense as it gives you protection against financial damages or losses that may arise from a motor accident.

It covers you for personal injury that you may cause to third parties, and can cover your costs if you damage someone else's property. It can also cover any other loss or damage that you may suffer in a motor accident.

A motor insurance policy typically imposes an excess which is the cost you may be required to bear in the event of a claim being made against your policy. Generally, the more risk the insurer carries the higher the excess will be.

Common Motor Insurance Packages

What are some common packages available in the market and how do you select one that is suitable?

Third Party

- Death or injury to other parties

- Damage to other parties' property

Third Party, Fire and Theft

- Death or injury to other parties

- Damage to other parties' property

- Fire damage to, or theft of, your vehicle

Comprehensive

- Death or injury to other parties

- Damage to other parties' property

- Fire damage to, or theft of, your vehicle

- Accidental damage to your vehicle

- Windscreen damage

- Damage arising from riot, strike and civil commotion

- Personal accident cover (private car only)

- Medical expenses (private car only)

Optional Benefits for Comprehensive Policies

(May be subjected to payment of additional premium)

- Damage arising from flood and windstorm

- Liability of passengers for acts of negligence

- Personal accident benefits for passengers

- Additional excess

- No-Claim Discount protection (private car only)

What is a No Claims Discount and how does it work?

A No-Claim Discount (‘NCD’) is an incentive given to you if no claim has been made under your policy for a year or more with your current/existing insurer. It reduces the premium you have to pay for the following year. This is your insurer's way of recognising and rewarding you for having been a careful driver. The rate of NCD depends on your type of vehicle (private or commercial/motorcycle) and the period of insurance with no claim.

The following table shows a common method to calculate the rate of NCD.

| Private Car Policies | Period of insurance with no claim | Discount on renewal |

| 1 year | 10% | |

| 2 years | 20% | |

| 3 years | 30% | |

| 4 years | 40% | |

| 5 years or longer | 50% | |

| Commercial Vehicle & Motorcycle Policies | 1 year | 10% |

| 2 years | 15% | |

| 3 years or longer | 20% |

NCD is just one of the factors affecting the premium. Premium quoted by an insurer based on a higher NCD would not necessarily be lower than that quoted by another insurer based on a lower NCD in a competitive market. Consumers are advised to shop around and compare premium rates before buying.

If I make a claim, will I automatically lose my NCD?

Not necessarily. Your NCD may not be affected if you are found totally not at fault in an accident involving another vehicle. In all other cases, your NCD may be affected.

If there is a claim made under the policy, your NCD will be reduced as follows.

| Private Car Policies | Current NCD | NCD after 1 claim |

| 50% | 20% | |

| 40% | 10% | |

| 30% and under | 0% | |

| Commercial Vehicle & Motorcycle Policies | 20% / 15% / 10% | 0% |

If you make more than one claim in a year, your NCD will be reduced to 0%.

Please check with your insurer whether your NCD will be affected.

Some insurers do offer a protection on your NCD in the event of a claim. Please refer to question “Can I insure against the loss of my NCD?” to find out more.

Is my NCD transferrable?

In principle, your NCD applies to you and not to your vehicle. For example, if you sell your vehicle and buy another one, you will retain your NCD. However, if you own more than one vehicle, you might have a different NCD for each vehicle. You should check the details with your insurer, but generally:

Your NCD can-

- Be transferred if you decide to switch insurer.

- Be transferred to another vehicle you own, but it cannot be applied to more than one vehicle at any point in time. For example, if you have accumulated a 30% NCD while using one vehicle, it does not follow that the same NCD applies to any other vehicle that you own or decide to buy. In other words, you will have to earn the NCD for each vehicle separately.

Your NCD cannot -

Be transferred to another person, except for your spouse and within the current insurer only. Transfer of NCD to your spouse will not be applicable if you renew your policy with another insurer.

Will I lose my NCD if there is a break in ownership of my vehicle?

Most insurers in Singapore will allow you to keep your NCD should there be a break in vehicle ownership for up to 24 months. Some insurers set the timeframe at 12 months. You should contact your insurer for details.

Can I insure against the loss of my NCD?

If you have accumulated a certain level of NCD, for example 50% NCD (five years or longer without a claim), some insurers may allow you to buy protection against the loss of the discount.

By paying a small amount of extra premium, you can make one claim within the period of insurance, and still have the NCD fully protected. The protected NCD is as follows:

| Claims made during the period of insurance | Protected NCD Entitlement upon renewal with same insurer (Private Car Only) | NCD Entitlement upon renewal with new insurer (Private Car Only) |

|

|

|

Unlike NCD, the protected NCD may not necessarily be transferable to another insurer. Having an NCD Protector will also not protect you against non-renewal or cancellation of your policy by your insurer.

The features of a NCD Protector may differ from insurer to insurer. Always check carefully and understand how the NCD protection cover works before purchasing the protection.

Please check with your insurer whether NCD protection cover is available.

How can safe driving save me even more money?

If you have not violated any traffic rules for three consecutive years, you are entitled to a Certificate of Merit from the Singapore Traffic Police.

Should your NCD be 30% and above for a private car policy or 20% for a privately owned commercial vehicle policy, some insurers may reward you with a further 5% discount upon presentation of your Certificate of Merit.

Insurers might not insure vehicles with modifications to the vehicle, notwithstanding that the modifications passed LTA's inspection standards. Motorists must declare all modifications, irrespective of acceptance by LTA, for underwriting.

- You must inform your insurer if you make any modifications to your car, even if it has passed LTA’s inspection standards. Non-disclosure may result in your claims being repudiated.

- Many insurers consider modifications made to a car as material information in deciding what premium to charge for a policy; some insurers also do not wish to insure modified cars.

- We recommend in all instances where your car is modified that you advise your insurer or prospective insurer of what changes have been done to your car.

What is considered "modification?" Does it affect both big and small changes to my vehicle? For example, I want to switch my wheel to sports rims. Does this apply? What about changing the in-vehicle radio to a multi-DVD entertainment system? Does this apply?

Modification refers to changes made to a car which are directly related to how it operates as a car. This includes changes to engine performance, drive train, air intake systems, exhaust systems, transmission systems, or any changes to the handling characteristics of the car including suspension systems, strut towerbars, or bracing as well as any changes made to the control unit of such parts. This list is not exhaustive.

Routine maintenance where like-for-like parts are used, that is in accordance with the manufacturer's standard specifications, will not be considered as modification.

Accessories are parts of your car which are not directly related to how your car operates and will not impact your insurance coverage. This include upholstery, audio equipment, multi media equipment, communication equipment, personal computers, satellite navigation and radar detection systems, provided they are permanently fitted to the car and have no independent power source.

Changes made to rims/tyres and body kits are not considered a modification when they are within the manufacturer's defined and acceptable specifications. However please note that in case of any damage during an accident, insurers will only replace or repair with suitable part(s) in accordance with the manufacturer's standard specification.

If you require further clarification, please contact your insurer.

How do modifications impact my annual motor insurance premiums? Will I have to pay more for my motor insurance because of these modifications?

Do ask your insurer and shop around. Some insurers charge additional premiums and some do not. We recommend that in all instances where your car is modified that you advise your insurer or prospective insurer of what changes have been done to your car and ask how your premiums and coverage, may be affected.

Non-disclosure of vehicle modifications may result in repudiation of claims by your insurer.

Work Injury Compensation Insurance

Insurance that pays for medical care and physical rehabilitation of injured workers and helps to replace lost wages while they are unable to work.

Work injury compensation insurance is compulsory for all employees doing manual work, as well as non-manual employees earning less than $2,600 a month.

Please visit the Ministry of Manpower's website for more information.

What happens if an employer is refused work injury compensation (WIC) insurance quotes from at least 10 WIC designated insurers?

If an employer is refused WIC insurance quotes from at least 10 WIC designated insurers, the employer can seek help from GIA.

To do so, the employer will need to:

1.complete the checklist to provide information about the WIC designated insurers who have refused to quote WIC insurance

2.complete the Declaration form:

- Declaration Form for single entity

- Declaration Form for multiple entities

3.submit the completed Checklist supported with documentary evidence and the Standard Declaration Form to This email address is being protected from spambots. You need JavaScript enabled to view it. with the subject “WICI submission by [insert employer’s name]”

Important Things to Note

|

1.The Checklist should be completed by the employer’s officer in charge of WIC insurance or can also be completed by the employer’s insurance intermediary. The Standard Declaration Form should be completed by the employer’s officer in charge of WIC insurance. 2. The following situations do not constitute refusal to quote by an insurer: 3.Refusals by insurers need to be supported with documentary evidence. Submissions without supporting documentary evidence will be rejected. 4. If GIA is not satisfied that an employer has made out its case that it has been refused WIC insurance quotes from at least 10 WIC designated insurers, the employer will need to approach other designated insurers for quotes, directly or through your insurance intermediaries. 5. If GIA is satisfied that an employer is refused WIC insurance quotes from at least 10 WIC designated insurers, GIA will send the completed Standard Declaration Form to a panel of insurers and ask the insurers to provide WIC quotes directly to the employer. |

Work Injury Compensation Act (WICA) 2019

The new WICA 2019 will take effect on 1 September 2020 and will offer the following benefits for both employers and employees:

- Influence companies to prevent injuries from happening in the first place

- Faster and simpler claims processes for everyone

- Enhanced protection for employees

- More certainty for employer

To prepare for WICA 2019, employers are reminded to:

- Obtain WIC insurance coverage for employees (unless they are exempted), throughout the employment period.

- Purchase or renew their WIC insurance coverage in a timely manner.

- Finalise all insurance contracts and provide the information required to your insurer at least 21 days before policy commencement. This should be done for all policies commencing 1 January 2021.

For more information and latest updates on WICA 2019, please visit the Ministry of Manpower's website.

(1) What if I have a dispute with my insurer?

If you feel you have been treated unfairly by your insurer, you should lodge a complaint directly with the insurer, and provide the insurer with your details (name, contact numbers, etc.), the specific nature of your complaint and supporting documents.

The insurer should acknowledge your complaint within 7 business days, and if necessary, request additional information from you within 7 business days of the date of your complaint.

Depending on the nature of your complaint, the insurer may need more time to attend to it. If so, the insurer should contact you and update you on the progress within 15 business days of your last communication, before proceeding to resolve the problem.

If you have taken these steps and still feel the response is not satisfactory, or if there is no response within the timeframes stated above, you should then appeal to the Chief Executive of the insurer in writing. You can expect a response to this within 15 business days.

Finally, if you are still unsatisfied after going through these channels, you can contact the Financial Industry Disputes Resolution Centre (FIDReC). You must do so within 6 months of your insurers' final reply to you. FIDReC is an independent institution, which aims to provide consumers with a one-stop avenue for resolving disputes in the banking, insurance and capital market sectors. FIDReC does so by offering mediation and adjudication services.

Filing a complaint is simple and free of charge. You may lodge your complaint online at www.fidrec.com.sg. If you have any queries or difficulties in lodging the complaint, you may submit an enquiry at www.fidrec.com.sg or contact FIDReC at 6327 8878. Once your complaint is lodged, FIDReC's Case Manager will verify if the dispute falls within FIDReC's jurisdiction and will reach out to you should any further information be required.

FIDReC Contact Centre

36 Robinson Centre

#15-01, City House

Singapore 068877

Opening Hours:

Mondays to Fridays: 9am to 6pm

(not including public holidays)

(2) If I have a dispute with the third party insurer on the question of liability and quantum of settlement amount, who can help me to resolve the dispute?

You can approach FIDReC. In addition to handling insurance disputes involving claims between insureds and their insurers, FIDReC also handles motor third-party property damage claims of up to S$100,000 (for claims filed before 1 July 2024) or S$150,000 (for claims filed on or after 1 July 2024).

For more information on the jurisdiction of FIDReC, please visit www.fidrec.com.sg.

13. Help & Support

Property Insurance

Coverage protecting property against loss caused by a fire or lightning that is usually included in homeowners or commercial multiple peril policies.

Common Types of Home Insurance

Your home insurance needs can vary depending on the type of property. Here are 3 common types of home ownership:

|

Property Types |

HDB homes |

Private apartments or homes with Strata Title |

Landed homes or private property without Strata Title |

|

Building & Structural Coverage |

|

|

|

|

Home Contents Insurance |

|

||

|

Mortgagee Interest Policy (MIP) |

|

||

What Does Fire Insurance for Residential Property Cover?

Most fire insurance for buildings cover against damages caused to an apartment/unit by:

- Fire

- Lightning

- Domestic Explosion

- Bursting or Overflowing of Water Tanks and Apparatus

- Road Vehicle Impact

- Aircraft Impact

- Malicious Intent

- Riot and Strike

- Earthquake, Windstorm and Flood

Contents of your property are usually not covered. You have to purchase a separate or additional policy for home contents.

What Does Home Contents Insurance Cover?

It covers the contents of your apartment/unit, including:

- Appliances

- Furniture

- Ornaments

- Computers

- Kitchenware

- Books

- Personal Effects

- Fixtures & Fittings which do not form part of the building

This policy is also applicable to tenants.

15. Motor Insurance

Motor Insurance Protects You against Financial Damages or Losses That May Arise from a Motor Accident

Besides the fact that it is against the law in Singapore to drive a motor vehicle without a valid insurance policy to cover third party bodily injury, motor insurance makes good sense as it gives you protection against financial damages or losses that may arise from a motor accident.

It covers you for personal injury that you may cause to third parties, and can cover your costs if you damage someone else's property. It can also cover any other loss or damage that you may suffer in a motor accident.